RBSi

2020 brought core objectives into focus for RBSI, one of them was expand their flagship platform: eQ Mobile.

eQ Mobile is RBSi’s mobile banking experience for business customers. The current app serves as an approval & authorization tool for the much more extensive web version. Our challenge was to identify which feature could we incorporate into eQ Mobile that would improve customer journeys & experiences, and expand the reach of the app so that it could eventually become a selling point for futre clients.

The challenge

The solution

Focus on the Accounts & Balances.

Part of the authorisation journey for eQ users, is checking all their accounts have the necessary funds to make a transfer or transaction. It seemed like the natural evolution of the app to include this feature into it. We had also determined that it would allow us to reach an extra 30% of customers approximately.

Screenshot from the working file

The process

-

eQ web audit

Before jumping into designing the app, we had to understand how the web version of Accounts & Balances works. What’s available to the users? How much information is displayed? How does it interact with the rest of the product?

-

User research

Once we know what Accounts & Balances is all about, we had to learn how our users actually use it. Specially within the context of the authorisation journey since that’s what was currently in the app and the two had to go hand in hand.

-

Design

With all of this information about our user’s behaviors and the business requirements, we can start ideating and creating some concepts. Throughout this stage, I kept a very close collaboration with the development team to avoid running into any technical feasibilities later on production.

-

Validation & iteration

With the initial designs created, approved by RBS & confirmed to be technically feasible, we once again went to our users to validate them and make sure we can send it into production.

The designs

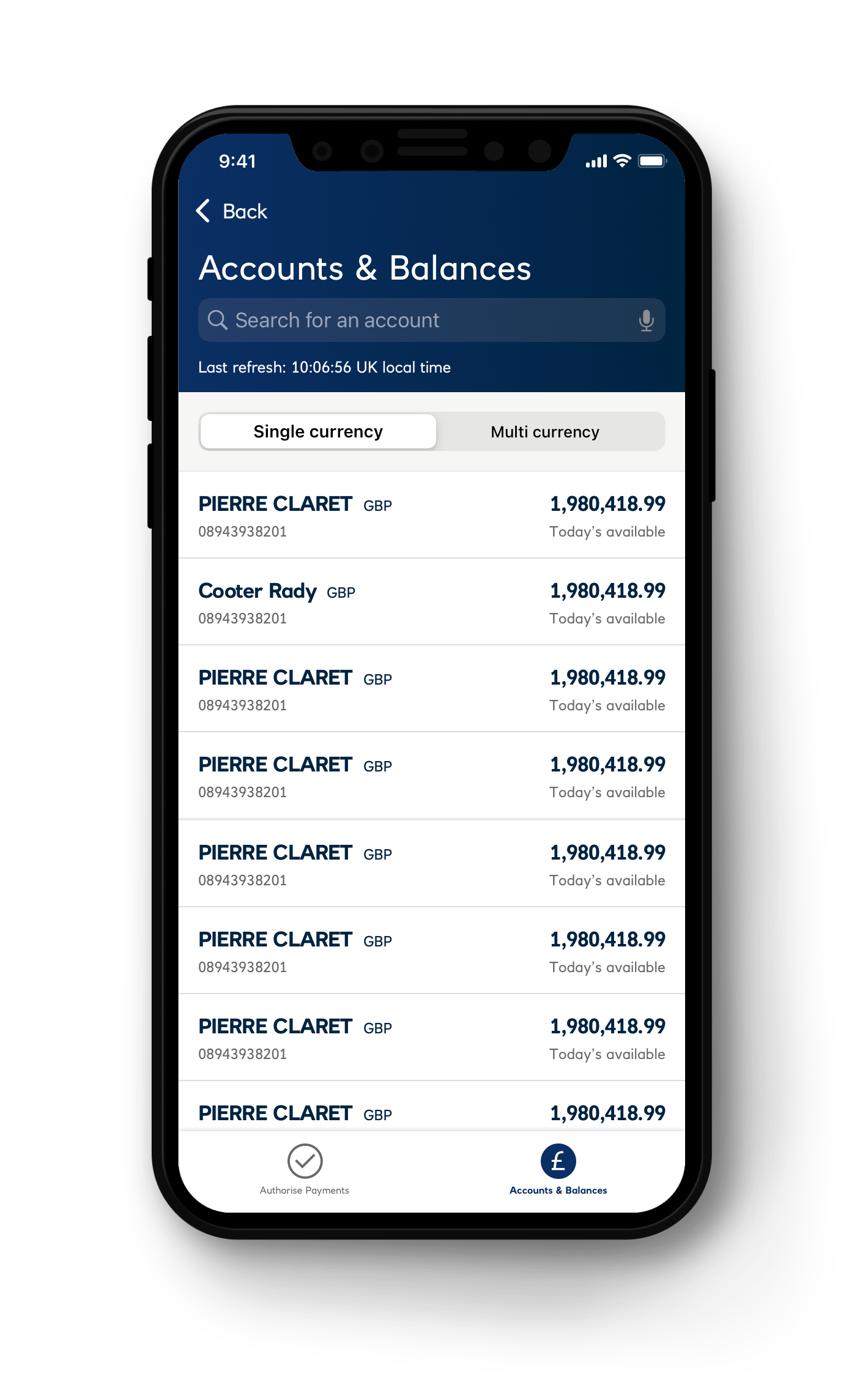

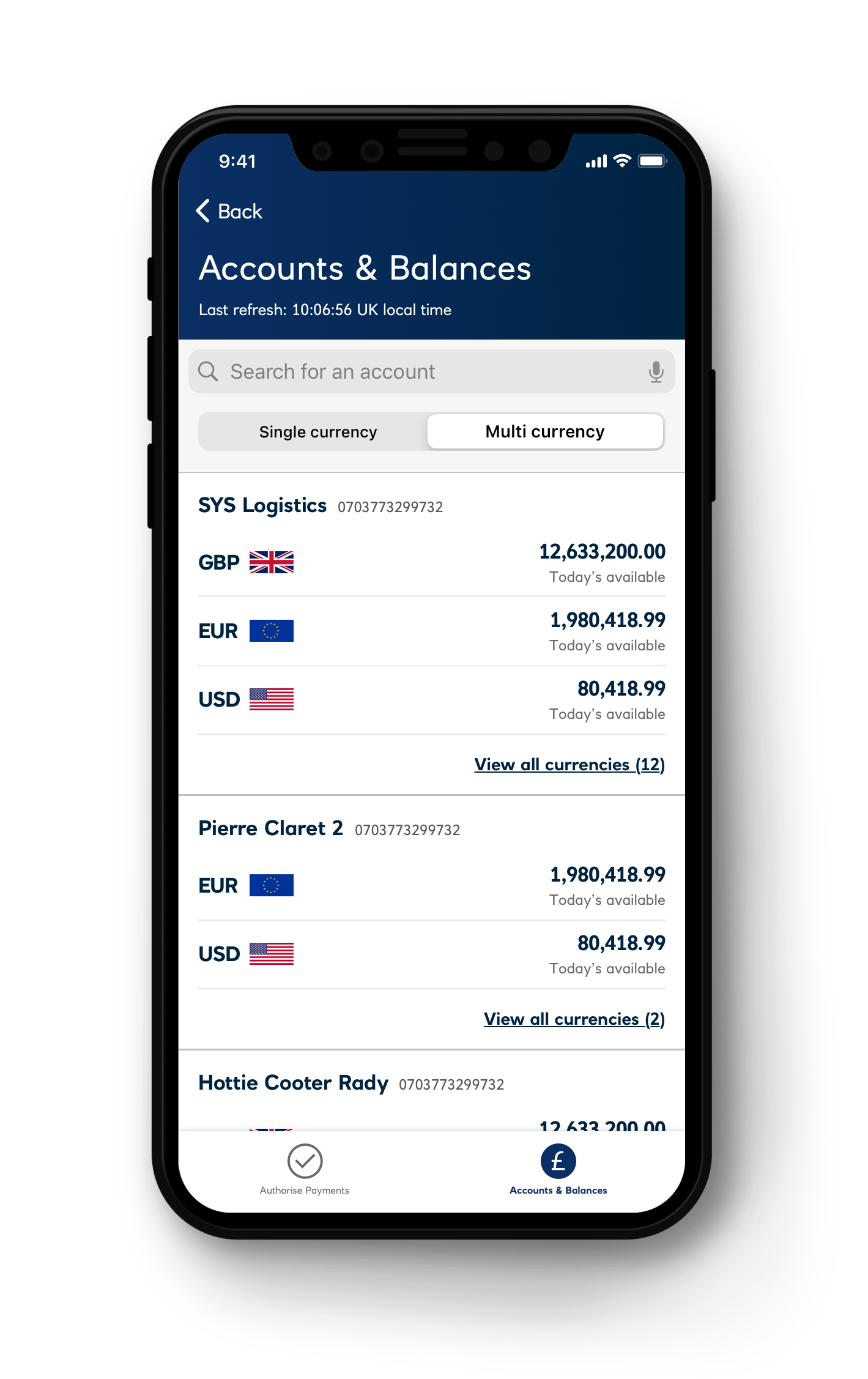

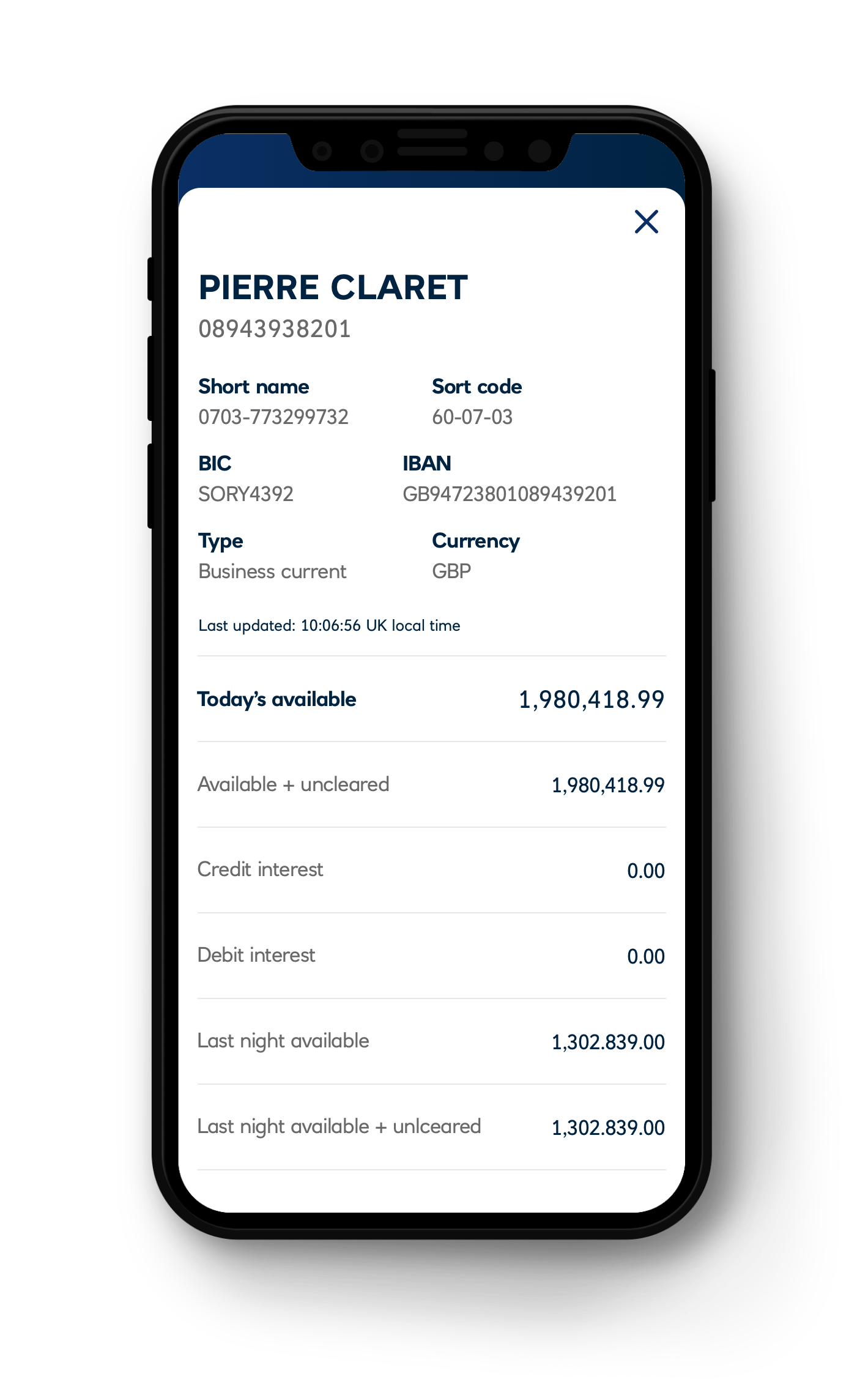

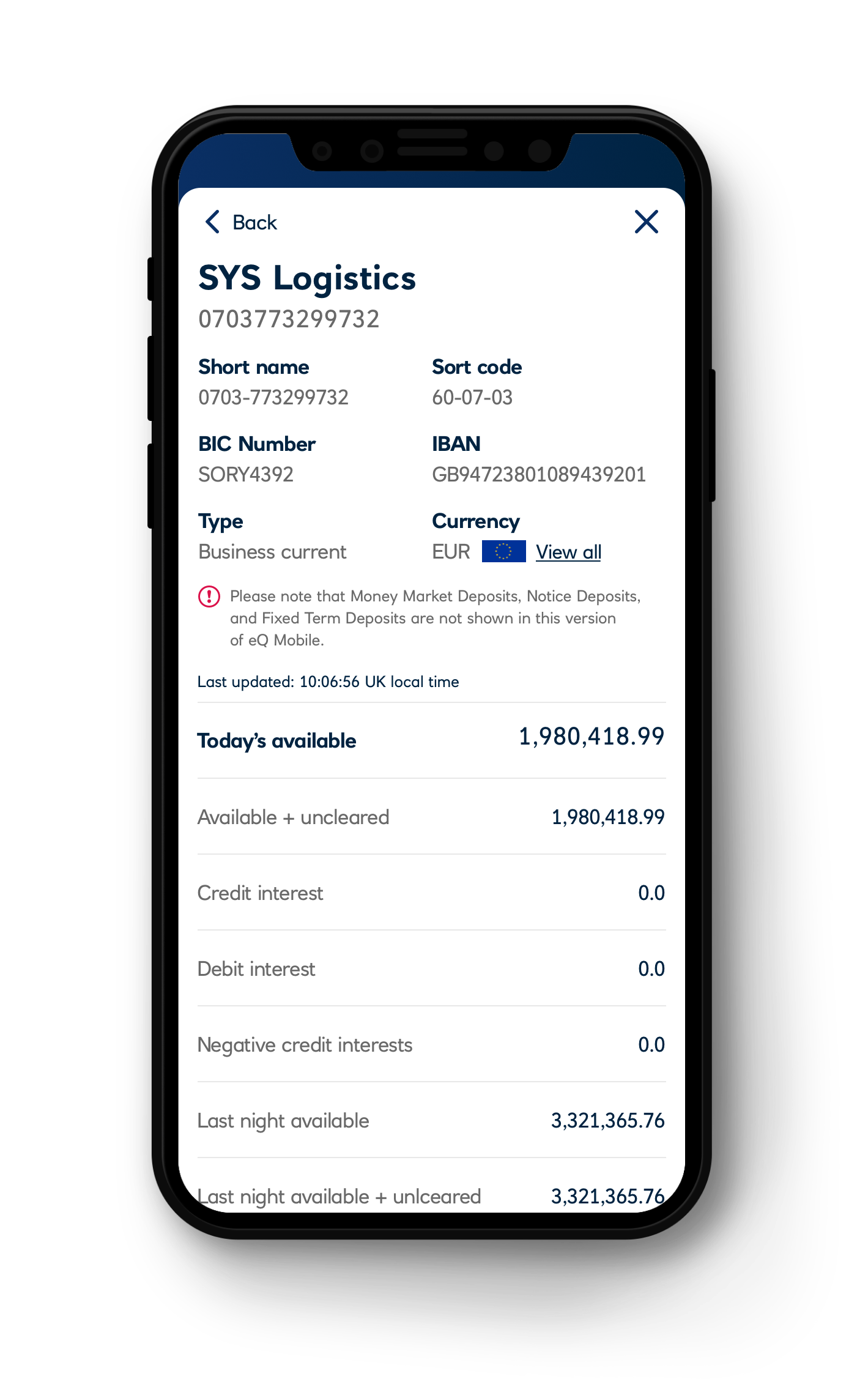

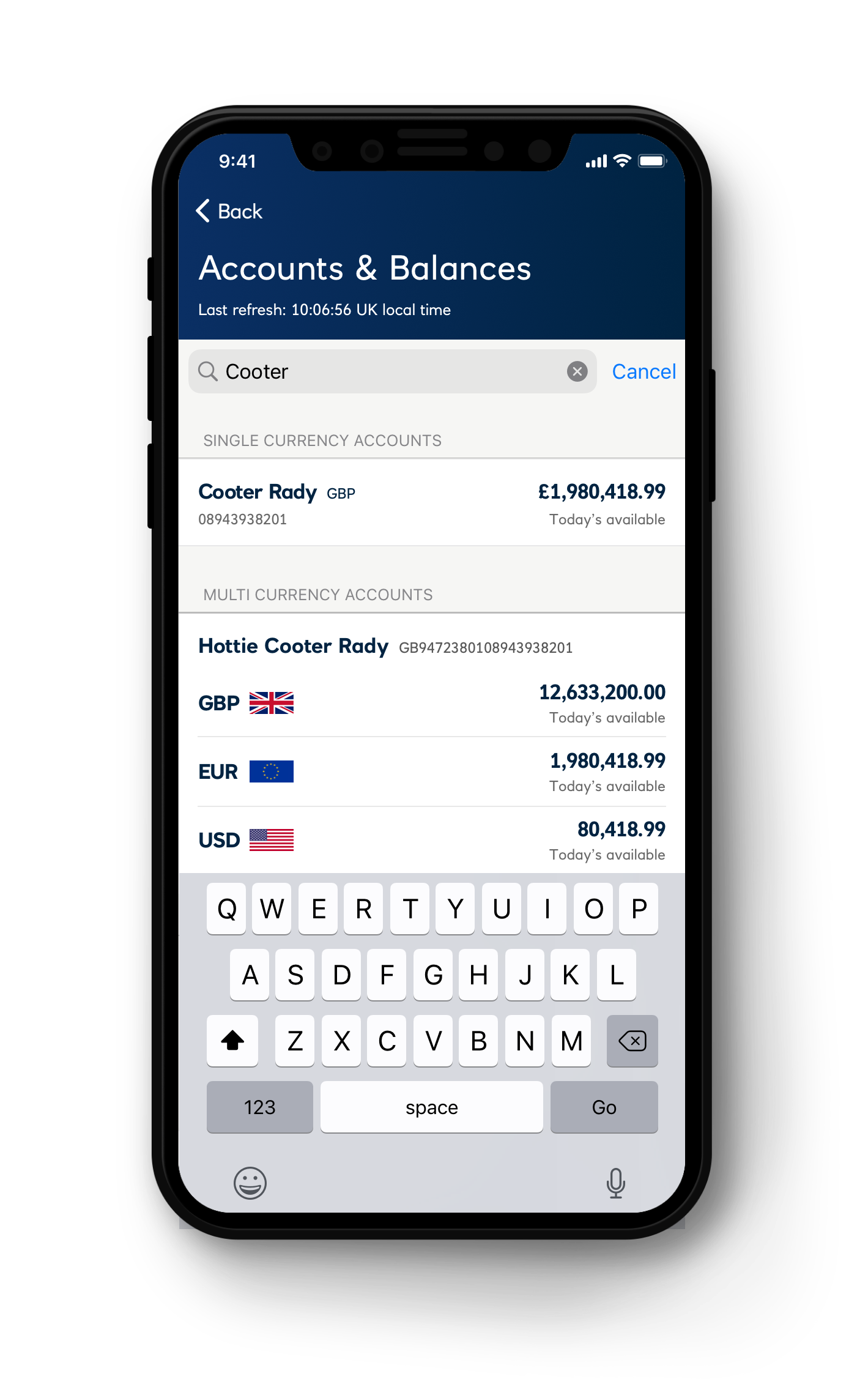

These are the final screens that went into production and will eventually launch before the end of this year. They are the first iteration of this feature, and they incorporate the basic information needed for each account before authorizing payments.

Scroll view

Accounts landing page for single multiple accounts

Single currency account details screen

Multi currency account details screen

Multi currency (one currency selected) account details screen

Search functionality

The proposal will go live in 2021